- 25/12/2020

Bad Debt Expense: Definition and How to Calculate It Bench Accounting

Content

Bad debt expense helps you quantify lost receivables and measure collection effectiveness. BDE is also a measure of the quality of your overall customer experience since healthy customer relationships mean fewer disputes and uncollected invoices. You’ll calculate your bad debt allowance for each aging bucket then add these totals all together to find your ending balance. It is reported along with other selling, general, and administrative costs.

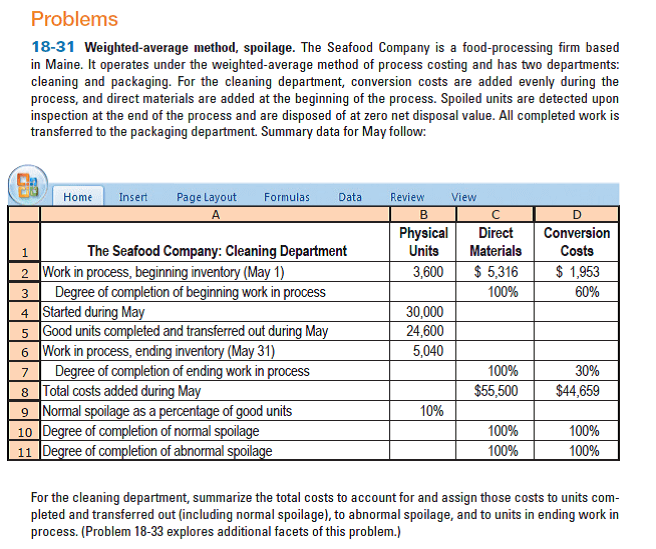

Debit “allowance for doubtful accounts” in a journal entry in your accounting records by the amount of the uncollectible invoice. So far, we have used one uncollectibility rate for all accounts receivable, regardless of their age. However, some companies use a different percentage for each age category of accounts receivable. When accountants decide to use a different rate for each age category of receivables, they prepare an aging schedule.

Protect Your Business Against Bad Debt Expense

Instead of doing one calculation for the entirety of sales, you age your accounts receivables. Based on this year’s numbers, the tech company should create a bad debt reserve equal to 7% of sales in the next year. It doesn’t follow the matching principle in accrual accounting, which states that an expense needs to be reported https://business-accounting.net/ in the same period as the transaction occurs. In effect, the allowance for doubtful accounts leads to the A/R balance recorded on the balance sheet to reflect a value closer to reality. The allowance for doubtful accounts is then used to approximate the percentage of “uncollectible” accounts receivable (A/R).

Ensure consistent regulatory and tax compliance by automating non-trade transactions and invoices while enforcing trading relationships and policies, as well as required taxes and transfer pricing. Streamline and automate detail-heavy reconciliations, such as bank reconciliations, credit card matching, intercompany reconciliations, and invoice-to-PO matching all in one centralized workspace. Harold Averkamp has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Relevant resources to help start, run, and grow your business, delivered twice a month. Send automated invoice reminders with QuickBooks to follow up on outstanding balances. The tools and resources you need to take your business to the next level. The tools and resources you need to get your new business idea off the ground.

What is the benefit of bad debt protection?

Take, for example, a company that sells 400 tablets at $1,000 each during the month of May. We can therefore estimate that two of those sales would turn into chargebacks for a loss of $2,000, and record that amount as the bad debt allowance for May.

- Global and regional advisory and consulting firms bring deep finance domain expertise, process transformation leadership, and shared passion for customer value creation to our joint customers.

- This small balance is most often estimated and accrued using an allowance account that reduces accounts receivable, though a direct write-off method may also be used.

- The aging method groups all outstanding accounts receivable by age, and specific percentages are applied to each group.

- This amount needs to be removed from the Accounts Receivable by showing it as an expense.

- Using the percentage of sales method, they estimated that 5% of their credit sales would be uncollectible.

- The adjustment value is the difference between the ending AFDA balance and the starting AFDA balance.